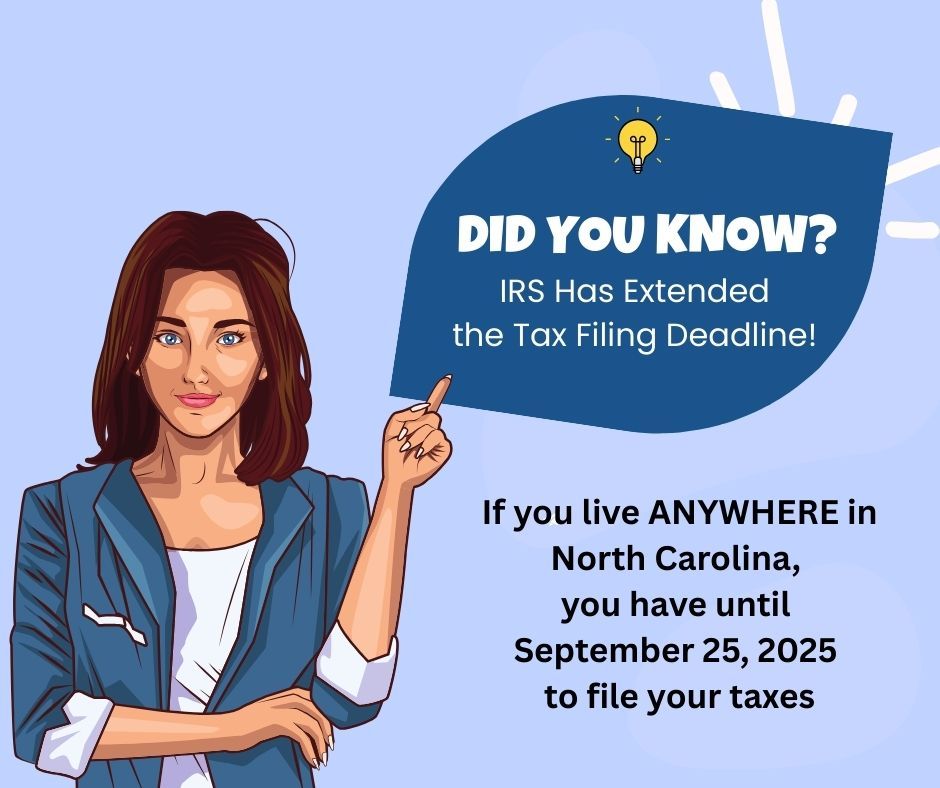

IRS Extends Federal Tax Deadlines for North Carolina Storm Victims

New IRS Deadline Applies Across North Carolina

The Disaster Relief now applies to all North Carolina Taxpayers, not just the Storm Victims.

When disaster relief that includes everyone is announced, it can be hard to know what actually applies to you—or what steps to take.

That’s why we’ve laid out the most important dates, rules, and details in one place, all based on the latest updates from the IRS and NCDOR.

You Have Until September 2025

to File Your Taxes this Year

Here’s What this Means for You

If you live anywhere in North Carolina, the IRS has officially extended your federal tax deadlines to September 25, 2025 due to Hurricane Helene. This applies to every taxpayer in the state, whether you’re filing as an individual or running a business—no additional forms or requests needed.

Did You Forget to File Your Taxes This Year?

This tax extension is a perfect opportunity if you missed the April 15 deadline. It doesn’t matter whether you were personally impacted by the storm or live in a designated disaster area—every North Carolina taxpayer is included.

It’s a rare second chance to file and pay your federal taxes without interest or penalty, as long as everything is submitted by the September 25, 2025 deadline.

Here's How We Can Help

At Carolina Business Services, we work with clients across North Carolina—from the mountains of Asheville and Boone, through the Piedmont cities like Greensboro, Charlotte, and Raleigh, all the way to New Bern, Jacksonville, and the coastal communities around Wilmington.

No matter where you are, there's no need to visit our office in person. We use secure, encrypted email and flexible communication tools to keep your documents protected and your process simple. You’ll get the same personal attention and professional care—without ever needing to leave your home or office.

Whether you’re newly eligible for the extension or just looking for dependable tax help this year, we’re here to help you file with confidence and stay on track.

Who Qualifies for the Extended Deadline

- Anyone living or operating a business in North Carolina

- Taxpayers whose records are located in the state

- Relief workers assisting with storm recovery efforts

The IRS will apply the extension automatically if your address is on file in North Carolina. If you live elsewhere but your tax records are in the state, you may still qualify—call the IRS at 866-562-5227 if needed

Federal Tax Relief

What’s Due On or Before September 25, 2025

The IRS has moved multiple filing and payment deadlines into late 2025. Here’s what’s included:

- 2024 individual income tax returns (normally due April 15, 2025)

- Final 2024 estimated tax payment (due January 15, 2025)

- 2025 first, second, and third quarter estimated tax payments (due April 15, June 16, and September 15)

- Calendar-year partnership and S corporation returns (due March 15, 2025)

- Calendar-year corporate and fiduciary income tax returns (due April 15, 2025)

- Tax-exempt organization returns (due May 15, 2025)

- Quarterly payroll and excise tax returns due October 31, 2024, and January 31, April 30, and July 31, 2025

- IRA and HSA contributions for the 2024 tax year

Casualty Loss Deductions

If you suffered uninsured or unreimbursed storm damage, you may deduct those losses on your federal return. You can choose to claim the loss on your 2024 return or report it on your 2023 return. Be sure to include the FEMA disaster number DR-3609-EM when filing.

Lost or Destroyed Tax Documents?

The IRS will waive fees for copies of tax records lost during the disaster. File Form 4506 (for returns) or 4506-T (for transcripts) and include the FEMA disaster number on the form.

Learn more from the IRS by visiting the official tax relief announcement.

North Carolina State Tax Relief

What’s Included and What’s Not

Alongside federal relief, the state of North Carolina has extended filing and payment deadlines for income taxes. Here’s what to know:

State income tax returns and payments due between September 25, 2024, and September 25, 2025

Waiver of late action penalties during that period if the return is filed or the payment is made by the new deadline.

As long as North Carolina taxes are filed and paid by September 25, 2025, no late filing or payment penalties will be charged. However, if you owe state taxes, interest will still begin accumulating after the original April 15 deadline, even if you take advantage of the extension.

This relief doesn’t apply to all types of taxes—mainly state income taxes and related filings

If you're unsure how this state-level relief applies to your specific situation, Carolina Business Services can help make sure nothing is missed and that you’re taking advantage of all available extensions—federal and state.

You can find full details on the North Carolina Department of Revenue's

Hurricane Helene relief page.

Do I Need to Do Anything?

Taxpayers with a North Carolina address are automatically included in the extension—there’s no need to contact the IRS to be eligible. If you need additional time to file beyond the September 25, 2025 deadline for your 2024 return, you can still request a regular extension through the usual process.

Carolina Business Services serves clients across North Carolina—from Asheville to Wilmington and everywhere in between—so whether you’re nearby or hours away, you’re covered, and

we’re ready to help.